Capitol Connection: 7/15/2025

Federal Affairs

One, Big Beautiful Bill Act Signed

H.R. 1, also known as the One Big Beautiful Bill, has passed both the U.S. House of Representatives and U.S. Senate and has been signed into law by President Trump on July 4, 2025.

This sweeping legislation includes numerous provisions with both encouraging and harmful implications for businesses, individuals, and the overall economy.

The Lansing Regional Chamber of Commerce (LRCC) is currently analyzing the Act in detail and will continue to communicate the “what” and “why” behind these changes to ensure you are informed and prepared.

Educational Resources Coming Soon

We are working to develop educational resources through our LRCC Policy & Regulatory Business Education Series to help members understand and navigate these changes. Be on the lookout for upcoming sessions and materials.

Business Tax Changes

- Corporate Tax Rate Reduction

- Permanently lowers the corporate income tax rate from 35% to 21%, enhancing U.S. business competitiveness globally.

- Pass-Through Business Income Deduction

- Establishes a 20% deduction for qualified business income for pass-through entities (S corporations, partnerships, sole proprietorships), subject to income thresholds and limitations.

- Full Expensing of Capital Investments

- Allows 100% immediate expensing of qualified capital investments for five years, phasing out thereafter.

- Interest Expense Deduction Limitation

- Limits business interest deductions to 30% of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) through 2021, then switches to EBIT thereafter.

- Repatriation of Overseas Profits

- Imposes a one-time tax on untaxed overseas profits at 15.5% for cash holdings and 8% for illiquid assets, transitioning to a territorial tax system.

Individual Tax Relief

- Lower Individual Tax Rates

- Reduces tax rates across most income brackets, aiming to increase take-home pay for households.

- Standard Deduction Increase

- Nearly doubles the standard deduction to $12,000 (single) and $24,000 (married filing jointly).

- Personal Exemption Elimination

- Eliminates personal exemptions while increasing the standard deduction to simplify the code.

- Child Tax Credit Expansion

- Expands the Child Tax Credit from $1,000 to $2,000 per child, with up to $1,400 refundable for lower-income families.

- Creates a new $500 nonrefundable credit for other dependents.

- State and Local Tax (SALT) Deduction Cap

- Limits the SALT deduction to $10,000 combined for income, sales, and property taxes.

- Mortgage Interest Deduction

- Limits mortgage interest deduction to interest on up to $750,000 of debt for new home purchases (previously $1 million).

- Estate Tax Exemption Doubled

- Doubles the estate tax exemption to approximately $11 million per individual.

Childcare & Family Benefits

- The increase in the Child Tax Credit provides direct relief to families, helping offset childcare and household expenses.

- No specific new childcare expense credit was added in the 2017 TCJA provisions within this bill; the relief is through increased take-home pay and child tax credit expansion.

LRCC Perspective: Our Support for the 2017 TCJA Provisions in H.R. 1

The Lansing Regional Chamber of Commerce (LRCC) was a strong supporter of the 2017 Tax Cuts and Jobs Act (TCJA) and continues to advocate for preserving and strengthening its key provisions, including those recently reaffirmed in H.R. 1 (One Big Beautiful Bill). Ensuring the continuation of these pro-growth tax policies remains a top federal priority for the LRCC Policy Committee in 2025.

- Business Competitiveness & Growth

- The permanent reduction in the corporate tax rate to 21% and the 20% deduction for qualified pass-through business income provide essential relief to businesses of all sizes.

- These provisions enhance U.S. competitiveness globally, enabling Greater Lansing employers to invest in new equipment, facilities, and job creation.

- Certainty for Small Businesses

- Making the pass-through deduction permanent gives small business owners confidence to plan long-term investments and expand operations, a priority voiced repeatedly by LRCC members.

- Individual & Family Tax Relief

- The lower individual tax rates and expanded Child Tax Credit directly benefit working families, helping them keep more of their hard-earned income to afford childcare, education, and household expenses.

- Economic Growth & Community Impact

- By incentivizing capital investment through full expensing, the TCJA provisions support robust economic growth, benefiting not only employers but the entire regional economy.

State Affairs

State Budget Update: MI Legislature Misses July 1 Deadline

For the first time in nearly a decade, Michigan lawmakers missed the July 1 deadline to pass the state’s budget, leaving funding levels for schools and state agencies unresolved as the new fiscal year approaches on October 1.

Key Points:

- Deadline Missed: The Michigan Constitution does not require a budget by July 1, but it has been the standard practice for many years to ensure schools and local governments can plan. The Legislature adjourned for its summer recess without an agreement, and will not return until late July.

- School Funding Impact: Without a completed budget, public schools face uncertainty as they plan for the upcoming academic year. Many districts adopt budgets in June based on assumed state funding levels, and delays complicate hiring, programming, and financial planning.

- Sticking Points:

- House and Senate Differences: Disagreements remain on education funding levels, higher education appropriations, and how to allocate billions in general fund revenue.

- Economic Development Spending: Proposals to increase funding for economic development incentives are also a point of contention.

- What’s Next:

- The Legislature is scheduled to return today, July 15th to resume negotiations. Leaders remain hopeful a deal will be finalized before the start of the new fiscal year on October 1 to avoid partial government shutdowns or temporary funding measures.

- The Lansing Regional Chamber of Commerce will continue monitoring budget negotiations, especially provisions impacting economic development, workforce training, education funding, and infrastructure investments critical to business and community growth.

Ballot Proposal Update: Graduated Income Tax Delay

The Michigan Board of State Canvassers voted 3–0 to rescind its approval of the summary language for a proposed graduated income tax (GIT) constitutional amendment targeted for the November 2026 ballot.

Why It Matters:

- The proposal would replace Michigan’s flat income tax with a graduated system, doubling rates on income over $500,000 (single) and $1 million (joint) – making Michigan’s rate the highest in the Midwest.

- This would directly impact small and mid-sized businesses, most of which are pass-through entities taxed at individual rates, increasing costs for job providers.

What’s Next:

The Board has reopened public comment for seven days and will revisit the revised language at its August meeting or sooner if a special meeting is called.

Our Focus Moving Forward:

This is a temporary but important win for Michigan businesses. The Lansing Regional Chamber is working closely with our partners at the Michigan Chamber of Commerce and allied business organizations statewide to ensure any proposal is transparent, accountable, and protects Michigan’s economic competitiveness.

Regional & Local Affairs

The Gillespie Group plans $8M Remake of City Rescue Mission Buildings in Lansing's Stadium District

This project represents a much-needed and exciting step forward for our city. The redevelopment will help revitalize the Michigan Avenue Corridor by bringing:

- Additional housing units to our urban core

- Refreshed spaces to foster new retail and restaurant opportunities

- Improvements to public infrastructure, including curbs, sidewalks, and rain gardens

- Increased energy and activation benefiting both downtown Lansing and surrounding neighborhoods while providing positive experiences for visitors

We are proud to lend our support to this project and encourage the City Council to approve this redevelopment plan.

Opportunity to Engage: Step Into the Conversation

Two great opportunities to connect directly with decision-makers and see regional progress up close:

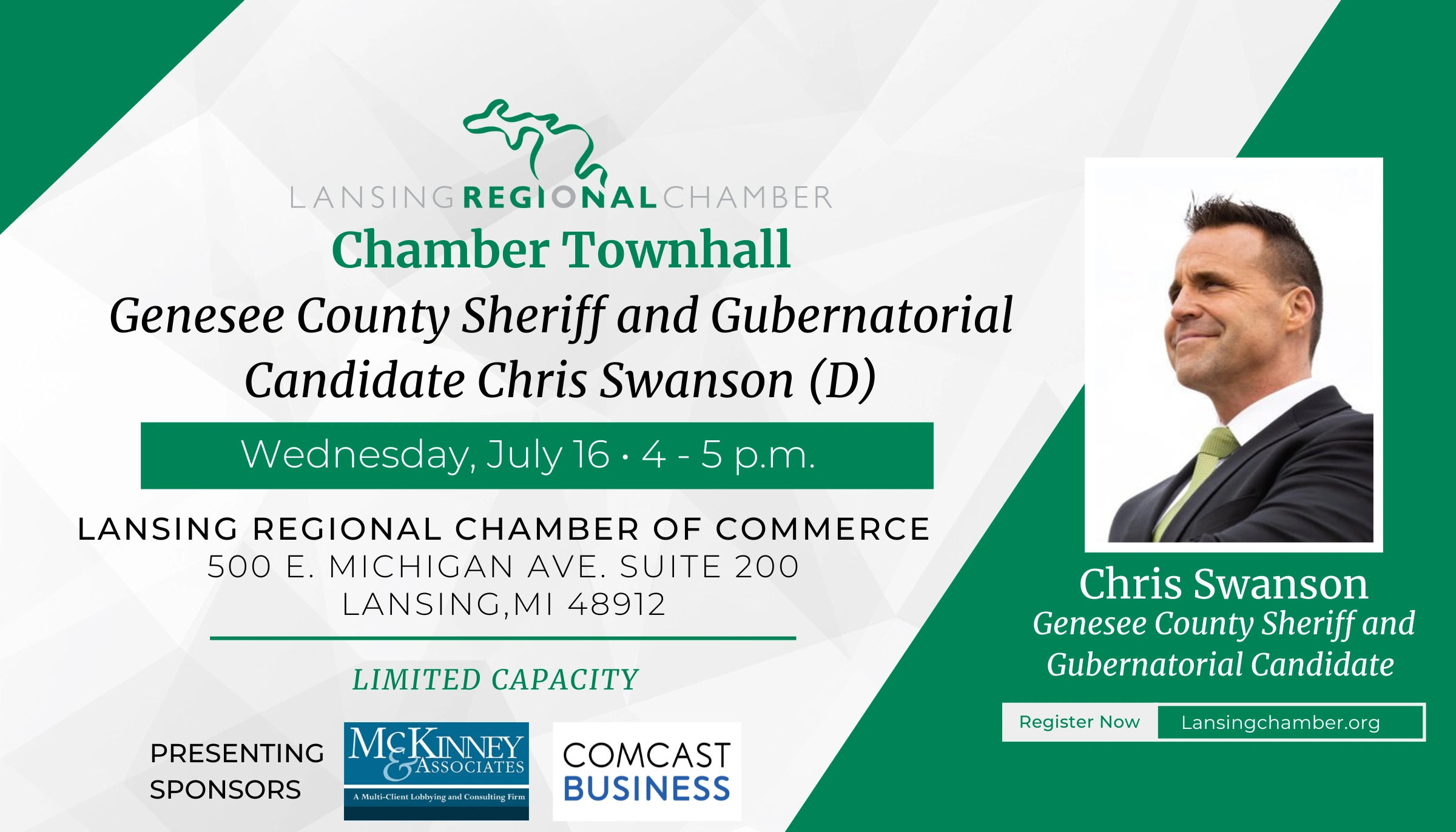

LRCC Chamber Townhall with Genesee County Sheriff & Gubernatorial Candidate Chris Swanson (D)

📅 Wednesday, July 16, 2025 | 🕓 4 – 5 p.m. 📍 LRCC Board Room

Hear firsthand from Sheriff Chris Swanson, a declared 2026 gubernatorial candidate, as he shares his vision for Michigan and answers questions from the business community.

LRCC Community Tour: Ingham County Justice Complex

Take a behind-the-scenes look at one of the region’s most impactful new developments. Learn how this investment supports public safety and economic development.

Welcome to the Help Desk

The Lansing Regional Chamber’s Public Affairs team is here to help you cut through the red tape.

From zoning challenges and permit delays to licensure questions and regulatory compliance, we’re your direct line to support at the local, state, and federal levels. Our mission is simple: help you solve problems faster so you can stay focused on running your business.

Need help? Let us know how we can assist you today